2021 was undoubtedly the year of crypto.

From the growth of DeFi, NFTs, gaming fever, and the solidification of the fabled institutional adoption meme, we have finally reached critical mass. Cryptocurrencies have become a multitrillion dollar asset class that leads the world in returns, and continues to draw-in the best talent from Wall Street, FinTech, and freelance entrepreneurs desiring alternative lifestyles.

The dominant trends of 2021 were:

- Layer 1 blockchains (SOL, LUNA, AVAX)

- NFT collections and digital in-game items

- Axies Infinity catalyzing the explosion of play-to-earn gaming

- Institutional adoption of Bitcoin

- Traditional VCs adopting crypto as an indisputable asset class

While it was unclear to many a year ago, it is now a consensus view that the future will be multichain and modular, comprised of many different blockchains that all communicate with one another and host apps that are effortlessly interoperable.

I am writing this to capture a moment in time, and express forward-looking views that more unique and actionable than “we are going multichain” and “layer 1s will continue to grow” because those have become foregone conclusions.

For context, my overarching view is that cryptocurrency markets will be bullish in 2022, albeit less than they were over the past year as conditions are beginning to shift on a macroeconomic level. With that being said, let’s get right into it.

Main Ideas Q1 2022:

- 2022 is the year of options, structured products, and stablecoins

- The bull market is not over, expecting us to finish higher in Q2

- DeFi Options grow more in % terms than any other sector in crypto

- Stablecoin Wars will define Q1 2022 and completely revolutionize DAOs

- Layer 2 everything has its first major bull run, driven by MATIC’s growth

- Fantom (FTM) will flip Solana by TVL

- Yield farming slowly becomes outdated, smart money focuses on options vaults

- Farming DAOs become a trend as people want yield without putting in the effort

- SoLunAvax underperforms a new index, FLAMingo

Options, options, options…

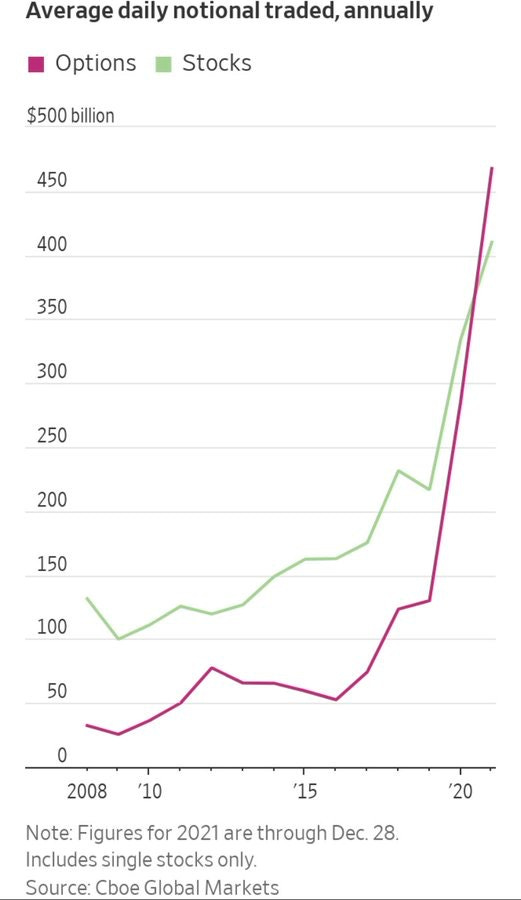

Since March 2020, the stock market has been Up Only driven by institutions and retail users using options to drive market higher. Options are more popular than they’ve ever been, and play a huge role in traditional markets. For a quick perspective, there were over $467 billion traded in options every day in 2021 for stocks. When it comes to buying and selling stocks, the number was only ~$410 billion. For the first time ever, options activity has exceeded that of stock trading.

Over the long run, crypto will function more like the stock market as institutions and major equities trading firms enter the space. It’s also important to note that the options market is extremely small today and operates a lot like crypto did in 2017. In 2021, crypto did $387 billion in total options volume between Bitcoin and Ethereum combined. That’s less than a day in the stock market. However, top cryptocurrencies averages much higher volume than most stocks and are much more liquid. At scale, it is not far fetched to expect crypto options to flip equities volumes. Put simply, if we’re at ~$1B per day in crypto options volume, then the upside is 500-1,000x from here.

In Q1 2022, I believe we will see the first major inflows into options protocols. Currently, the places to trade options in DeFi are:

Ribbon Finance $RBN

Dopex $DPX

Opyn (no token released yet)

Friktion Labs (no token released yet)

Lyra Finance $LYRA

Thetanuts Finance (no token released yet)

Katana (no token released yet)

Zeta Markets (no token released yet)

The beauty of options is that they can earn you passive income whether it’s a bull or bear market. With crypto, options are made even simpler because users can simple deposit money into a vault, and earn 30%+ yield on covered calls/cash secured puts while letting algorithms do the work for them. The yield becomes tokenized. You can then take that token and farm with it and earn even higher returns. This level of composability allows for supermassive, modular systems to be created around crypto derivatives that allow it to scale substantially faster than traditional markets. By nature, crypto is much more circular and self-fulling when it comes to metrics like TVL and volume. Once the fire is ignited and people decide to stop getting rugged by Uniswap V3, the inflection point of crypto options will appear obvious in retrospect.

As options vaults scale to billions in TVL, it will bring in a flood of new money. Vaults are able to reach people who don’t know how to yield farm or trade, plus those who are worried about holding coins that are falling in price during a bear market. Options are built for all-weather returns. I will cover them more later as there is a lot to discuss for Q1, but I am most optimistic on the future of Dopex $DPX in particular. The team is elite at building protocols, crypto-native, and highly creative with their tokenomics. I expect it Dopex to become the #1 options protocol in crypto in 2022.

Stablecoin Wars Are Going To Change Everything

First off, I am extremely, extremely bullish on stablecoins in Q1 2022. I haven’t been this bullish on something since DeFi summer was born in Summer of 2020. Now some of you may be thinking, “what does that even mean? Why would you be bullish on something that’s always $1?” Allow me to explain. Here is how dollars flow in the crypto ecosystem:

- People use fiat currencies like USD/EUR to buy stablecoins like USDT/USDC

- Most stablecoins are spent by investors to buy cryptoassets like ETH

- The rest flows to DeFi, with most making its way to Curve Finance which currently has ~$25B in deposits

Put simply, Curve Finance is the top place for people to earn yield on their stablecoins. Curve has its own token CRV, which is used to control how much in rewards goes to different pools across DeFi. Now if you’re a DeFi user, all you want to do is put your money where you can get the highest return. If you’re a protocol, you want to make sure your users make as much money as possible so they stay around longer. With higher rewards, everyone wins. Let’s dive deeper.

On the surface it sounds simple, but here is why things are about to get wild and trigger stablecoin mania. The key to all of this is the CRV token. The more CRV you own, the more you votes you have to control how much money each reward pool gets. It’s called “The Gauge”.

Think of the gauge as the money printer. Communities are buying millions of dollars worth of CRV every day so they can have control of the money printer. The ones with control will simply point it at their favorite holdings, so they can sit back and collect top-tier yield and have more power in DeFi.

Over the last six months, one protocol, Convex Finance, bought up over 51% of all CRV in existence because they realized how important CRV is in DeFi. They did this so that CVX holders can control who gets the most reward money, and it worked extremely well. I stated earlier that the Stablecoin Wars will revolutionize DAOs because now people are creating DAOs to pool together money just to buy CRV. It’s quickly becoming geo-politics, but on the blockchain. And what happens next?

A gold rush.

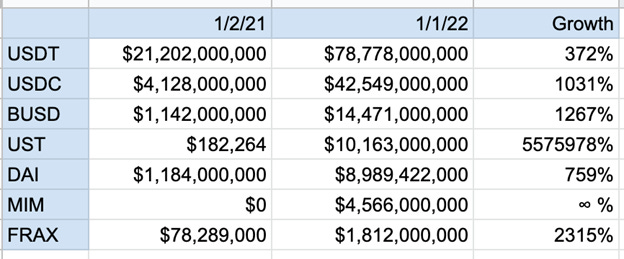

As mentioned earlier, LUNA is growing fast and there are currently over $10B UST in existence. LUNA has the 4th largest decentralized stablecoin in the world. They achieved this so quickly because by paying CRV bribes, and the amount they are buying is only going to increase as LUNA grows. If you’re bullish LUNA, you are also bullish Curve. There are also two other players in the stablecoin game.

MIM, a decentralized stablecoin associated with SPELL has nearly $5 billion total MIM in existence. Similarly, FRAX has nearly $2 billion stablecoins. They too, buy a ton of Curve so they can pump their bags and assert DeFi dominance.

Photo Credit: @Gojo_Crypto

If you’re bullish on DeFi, then by default you are bullish stablecoin growth because they power the entire ecosystem. Oh, and with over 90% of the CRV supply staked, and much of it locked up for 4 years, predictability is an added bonus. There is no massive farming and dumping going on, and we are going to run out of sellers soon.

TLDR: Without going too deep into the Curve Wars, the simplest explanation is that many of the biggest DeFi stablecoin buyers in the world are focused heavily on accumulating CRV so they have the best rewards pools, make the most money passively, and earn stable income for the long-term.

My preferred way to play the Curve Wars is REDACTED Cartel, which has the ticker $BTRFLY. It is the first authorized OHM-fork, has the approval of top OHM team members, and is backed by Tetranode and other notable DeFi participants. It’s currently earning 165,000% APY and priced at $2,500. I’m extremely bullish on BTRFLY because it’s backed by CRV and CVX. Why does that matter?

Because if the Curve Wars play out like I expect and CRV goes 2-3x higher from here, BTRFLY may return 4-5x from here while earning extremely high yields along the way. It’s leveraged exposure on the Curve Wars. If you missed OHM, and missed TIME, this one is for you. Keep in mind this is degenerate, so use common sense and don’t overexpose yourself by risking too much.

Different ways to play the Curve Wars:

Easy Mode (low risk): Buy CRV, CVX, and hold

Intermediate Mode (riskier): Buy CVX, FXS, and hold

Degen Mode (YOLO) : Heavy BTRFLY and FXS for max returns while earning 170,000% APY'

So boom, there’s your summary of the Curve Wars in the simplest way possible.

Now, let’s shift over to L1s and how to think about them moving forward.

Layer 1s: up only, or is the game changing?

It goes without saying that Layer 1 blockchains have been the runaway success story of the past year, though I believe this will change. A year ago, there was a dire need for new applications to be built on fast blockchains at low cost to users. The growth of Solana and Avalanche carried the market while ETH fees crushed everyday users, leading to a Cambrian explosion of activity on alternative chains. Although, I believe we see lower growth in 2022 as the market gradually transitions into a risk-off environment and stablecoins/DAOs become the most talked about sectors.

Irrespective of the market rising or falling, more money will be held in decentralized stablecoins than ever before. Among the layer 1s, the primary beneficiary of this macro trend is LUNA. UST, a decentralized stablecoin backed by LUNA as collateral. As demand for the UST grows, more LUNA is burned. This makes LUNA more scarce and lays the foundation for a supply side liquidity crisis. Additionally, over $11 billion is currently staked (largely in Anchor) which means LUNA holders are among the strongest and most resilient diamond hand holders in the industry. In addition, LUNA benefits from the stablecoin narrative I laid out earlier, so people will accumulate it as a safer way to gain exposure without holding more complex DeFi assets they are less familiar with (like CRV).

While SoLunAvax was the top meme of 2021, I think 2022 will look significantly different. Here, I’d like to present a new index of L1s and ecosystem related projects I expect to outperform.

FLAMingo (FLAM) – FTM LUNA ATOM MATIC

Let’s dive into these, starting with Fantom:

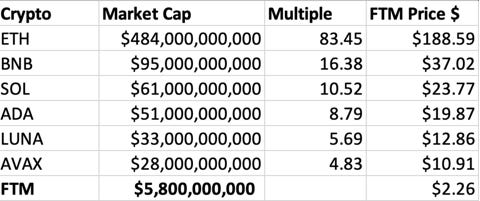

You may remember my bullet point in the beginning stating Fantom will flip Solana by TVL. There is a decent chance you read that and not only found it ridiculous, but extremely low probability. Allow me to make the bull case for FTM, which I believe is the most undervalued layer 1. At the time of writing, Fantom is worth $1.56.

- Fantom has 1.5 million addresses, the same as Avalanche

- FTM has developer activity on par with MATIC/LUNA, fast approaching AVAX

- Stablecoin growth on Fantom is rapidly accelerating, signifying organic demand

- Yet FTM is valued at 16% of LUNA, 22% of AVAX, & 30% of MATIC’s market cap

- Daniele Sestagalli and Andre Cronje, two of the top developers in the industry are spearheading FTM’s DeFi revival,

- YFI Money Markets + MIM/SPELL will likely bring Stablecoin Wars to Fantom

- SUSHI is being restructured to become the premier DEX of FTM. If successful, FTM will connect to over 20 chains instantly

- With respect to TVL, activity, users, and developers, FTM is 3-5x underpriced

If FTM were valued on par with other competitors, the price would be:

Photo Credit: @milesdeutscher

So why is Fantom so cheap and why will this change soon?

The most obvious reason FTM is mispriced is due to not being listed on major Western exchanges, and FTM DeFi having little competition and hype until now. As Stablecoin Wars intensify, it will trigger the explosion of yield farming on FTM (more money, more speculation, number go up). Additionally, with increased adoption of Abracadabra $SPELL, one of the most popular stablecoin protocols, Fantom users will be also able to lend/borrow money cross-chain and take out leveraged exposure using Abracadabra’s $MIM in higher amounts. Again, notice how all of these factors center around stablecoins and the power they wield in nascent ecosystems. Understanding these dynamics will give you an edge against the vast majority of market participants.

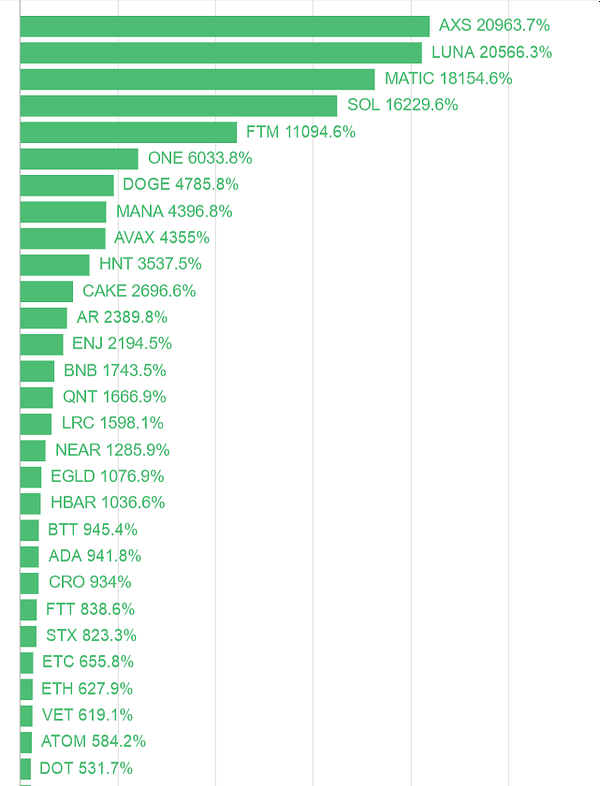

For the longest, Fantom has been viewed by many as a miscellaneous alt-chain that is not on par with SoLunAvax. People even praise Avalanche as being the “trade of the year last year” which is untrue when you look at the data, and I love AVAX.

2021 Returns:

Avalanche: 44x

Fantom: 111x

Solana: 162x

Clearly the market agrees that Fantom is worth accumulating, and in 2022 I expect for FTM to outperform Solana and Avalanche dramatically. The current discount is completely unreasonable, and I give it two months tops before Fantom goes on a run and people start to pile in. Bonus points if Spirit Wars (Curve Wars on FTM) start playing out. I am irresponsibly long FTM, and have been since $0.30.

SoLunAvax is for boomers. FLAMingo is the new narrative. Sprinkle in a lil’ NEAR/ATOM/ONE if you’re feeling fancy.

Moving down the index (I’ve covered LUNA already), let’s talk about ATOM.

Enter the Cosmos

Historically, ATOM has underperformed other layer 1s due to a lack of token value accrual and limited utility in the ecosystem. I believe this is the case for multiple reasons. First, ATOM is not a blockchain. It is a blueprint that allows developers to design blockchains (like Binance Smart Chain) and build applications. The networks built on top of ATOM are called Zones. LUNA is a zone. Secret Network is a zone. Cronos chain is a zone. Before this year, zones all had different levels of security and rules for governance, making them function more akin to different countries than states apart of an ecosystem. Interchain security is the next step in ATOM’s development that allows all of these different zones to share security, similar to how everything built on Ethereum has the exact same security level.

Not only does interchain security this make development easier, it also encourages users with a higher net worth to use ATOM. Part of the reason ATOM has underperformed is that each zone is unique with opt-in interoperability, meaning LUNA and Binance Smart Chain have not been interoperable by default—and it takes extra efforts by everyone to connect the different networks with bridges. This creates friction, and in instances where Binance Smart Chain is extremely unreliable for weeks in late 2021, the benefits of shared security become increasingly clear. With interchain security, LUNA/BSC/ATOM/Blockchain XYZ would all be running smoothly in parallel, connected via the Inter-Blockchain Communication (IBC) protocol, and users will be able to transfer assets between them very little additional effort. Interchain security will play a large role in the progression of the ATOM ecosystem, as the token will be necessary for staking and enabling communication across hubs.

Currently, roughly 60% of ATOM staked. With interchain security + IBC is implemented, this number is likely to rise north of 80% as users will be incentivized by higher APYs, increased functionality on Cosmos, and heightened connectivity to other blockchains. A burn mechanism is also planned, modeled after EIP-1559 for Ethereum, directly tying the scarcity of ATOM to the level of on the network. After EIP-1559 was deployed, Ethereum went on a bull run, as less liquid supply was available to sell as whales withdrew from exchanges, over 60% of the supply was staked, and new supply was being burned. With most participants holding, and new supply being taken out of circulation—who is left to sell? It also bodes well that ATOM will be in price discovery for 2022, meaning there will be no “bagholders” left to sell at arbitrary resistance levels or wait until they are breakeven to exit.

To expand on other features, the burn mechanism has been fundamental to the growth of LUNA over the past year, assisting it in becoming the second best performing asset. By proxy, ATOM has a decent probability of following a similar pattern of when successfully enabled and adopted by the community. Another aspect of ATOM less talked about is liquid staking, which allows users to lock their assets up in the Cosmos Hub in exchange for a synthetic asset such as “sATOM” which they can use to deploy on other projects in the Cosmos such as Anchor on LUNA, countless applications on Binance Smart Chain, and the burgeoning Cronos Chain.

As sATOM gains adoption, users will be able to earn multiple forms of yield via staking ATOM directly, farming with sATOM on other chains, and being able to take out loans using sATOM as collateral and actively managing their portfolios. The composability and flexibility of ATOM is not to be understated, and 2022 will bring major changes to the network which tend to significantly influence price positively. The risk of ATOM are development delays happening that push things back into 2023, although many of the aforementioned upgrades are well on their way towards completion. At this moment in time, ATOM is a waiting game full of information asymmetry. With patience, I anticipate ATOM to outperform and bridge the gap between itself and other leading layer 1 protocols.

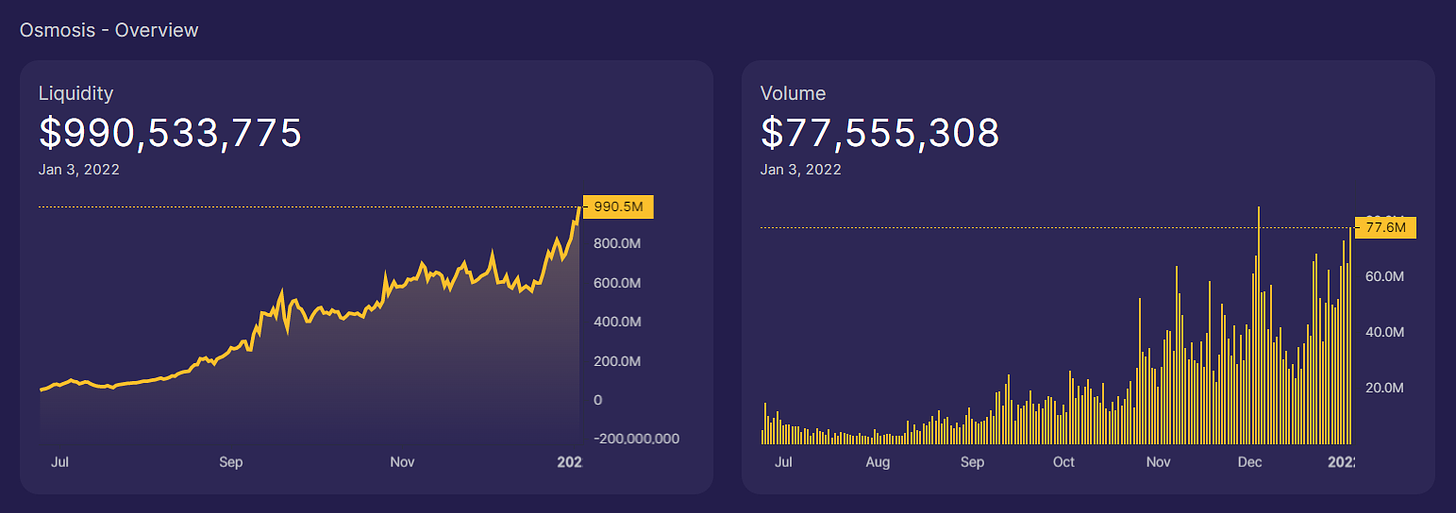

Osmosis DEX

Sidenote: Osmosis is the premier DEX of ATOM and worth monitoring, as growth has been extremely consistent and steady since inception. ATOM stakers will also receive airdrops for holding ATOM throughout the ecosystem from a variety of sources yet to be announced.

For traders: as ATOM moves, so do other coins closely connected with the network, particularly LUNA, OSMO, JUNO, SCRT, SHADE, and AKT.

Now, for the another very bullish case: MATIC.

MATIC is one of my highest conviction holdings for more succinct reasons. It’s long been said that you should bet on winners, and if we are judging off performance, MATIC is the #3 best performing crypto in the past year. Unironically, few understand this. Not only has it excelled from a price perspective, MATIC has quadruple the amount of daily active users as Avalanche. Yes, you read that correctly. Also the fees are an order of magnitude cheaper, coming in at a fraction of a penny versus $1-$5 on Avalanche, so it benefits from the same low-cost narrative meme once Ethereum gas fees begin to rise in the coming months. Similar to how Solana did.

From a high level perspective, venture capital funding for Layer 2 solutions is at an all-time high. The number of Layer 2 tokens is at an all-time high. Search interest, developers, demand from users, public funding rounds, games incorporating Layer 2 scaling—every conceivable metric related to layer 2 solutions is growing dramatically and MATIC is the only battle tested, index bet on layer 2 growth. If you are an institution seeking exposure to Ethereum related growth on layer 2, the only coin able to be accumulated with size is MATIC. Consider this when you think of the institutionalization of crypto over the coming years.

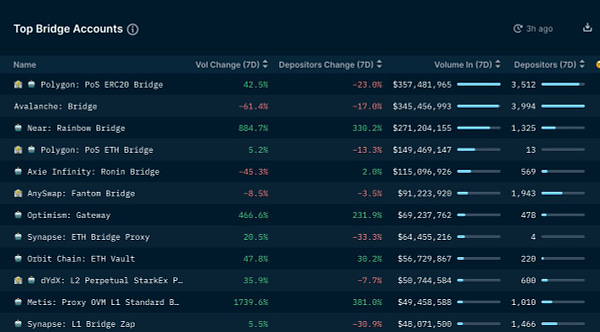

When it comes to inflows, there are more people bridging onto MATIC recently than ever before—but even if you were to zoom out, over $28 billion has already been bridged to MATIC which is far more than any other blockchain. Of all these new addresses coming aboard, only 15% of them have interacted with ETH which objectively proves MATIC is onboarding thousands of new users onto Web3.

Moreover, MATIC has always functioned as highly leveraged ETH exposure. If ETH continues on its path to $10k (it will), then MATIC will outperform significantly and lift the entire ecosystem of smaller related coins. With all of this taken into account, my perspective is that AVAX valued at $28B while MATIC is valued at $18B currently represents a clear mispricing relative to upcoming catalysts. There is also as ZK rollups, privacy solutions, and increased scaling on the horizon.

The team has been extremely active, and spent over 9 figures in acquisitions in the past year to scale faster than competitors. Polygon is also the only other popular chain integrated with Opensea. With the expected NFT revival in Q1, Polygon is positioned to onboard an influx of new users, while already having the highest adoption amongst NFT holders aside from SOL. At this stage, being overweight MATIC has an enhanced risk to reward for capturing upside, and it will be a major position of mine in Q1 2022.

For those looking for higher risk plays that are still in the L2 sphere, here are others I find promising: MUTE, SYS, DVF, LRC, DUSK, ZKP, METIS

Layer 1 Honorable Mention: NEAR Protocol

NEAR is another layer 1 that has flown largely under the radar to the general populous, but I believe in Q1 NEAR will have high inflows that not only boost the ecosystem and foster a new wave of development on-chain. Recently, they launched an $800M incentive program which has now grown into approximately $2B to provide developers with more resources to build new applications. While I am not of the view NEAR becomes a top L1 chain in the future, its ecosystem leader and early investors are taking meaningful efforts to rebrand it as a zero-fee, future-proof base layer scaling solution. The current price is $14.50.

Venture / Liquid DAOs

As more anonymous cartoon characters pop up all over the internet, many of them are smart degenerates who will find their way to the land of cryptocurrencies. In their current form, anyone with an audience can launch a DAO with a few other influential people and raise capital from the public to deploy into early stage investments. What makes Venture/Incubator DAOs promising is that the value of investments can be viewed in real-time. For example, New World Order DAO is a relatively new DAO that is incubating high quality projects, with the native token NEWO functioning as a quasi-claim on the assets.

Since the beginning, I have opposed launchpads, as they are too generalized to be highly effective at scale. By large, this thesis has proven to be true with few exceptions. Early stage networks need guidance from teams and people who can play a direct role in their long term success. In the Web3 economy, all of this will be done on chain and much more transparently—and do far more than the traditional VC model which is primarily advisory and funding.

This new model is one I refer to as “Liquid DAOs.”

Liquid DAO = Incubator + Yield + Venture (public token)

Ventures DAOs are notoriously more abstract with less transparency into holdings, and primarily deal with seed investments. Liquid DAOs buy already existing tokens on the open market, where all information is readily and freely available. Or, they incubate the tokens themselves and do public sales to the community where all of the terms are transparent and there are no short-term unlocks. They are much different than decentralized hedge funds because the combine the expertise of tech entrepreneurs, investors, traders, quantitative research, and development resources. I could probably write an article on this topic alone. Expect to see more projects like this gain traction, and become powerful forces in the DeFi ecosystem.

Earlier in this essay, I mentioned REDACTED Cartel, an authorized OHM fork backed by CRV/CVX. At the moment, NEWO owns 10% of the BTRFLY supply. The REDACTED position alone is valued at over $30M, and NEWO is only valued at $50M. In a few weeks, the BTRFLY position could be worth more than the total market cap of NEWO, and they have numerous other investments currently, and on the horizon. I’ll leave it up to you to speculate on what that means for price.

Keep in mind that BTRFLY is a rebase-coin, so they are also earning an obscene of money daily on their holdings that will only compound as the Curve Wars intensify. Then, they’ll use the CRV/CVX they own to boost yields even higher. This is a classic flywheel effect. Game theory is critical in DeFi, and more DAOs will rise to create alliances and rivalries that compete for the best opportunity not only in early stage investments, but farming, staking, and options strategies as well.

Farming DAOs (a form of liquid DAOs)

As people attain more wealth and the bull market begins to exhaust, there will be a natural shift towards DAOs that can allocate capital on behalf of users. If you’re in the United States, this is absolutely a security and banned by the SEC, but for the sake of simplicity we’ll assume this is entirely regulatory compliant. The best known iteration of this is Multi Chain Capital $MCC, which currently has $10M in assets under management. However, the best example I have seen of this is idea Reimagined.fi $REFI, which launched roughly two weeks ago. The way the DAO works is you buy REFI token, which entitles you to a percentage of revenues generated by the protocol. The team pools all money received, farms across different chains and pools, and redistributes the money to users.

The most innovative part about REFI is that users can be paid in ETH rather than REFI, meaning owners can essentially use REFI to accumulate more ETH while having exposure to farming at high yields. Additionally, REFI can be single sided staked to earn nearly 1,000% APY at the time of writing. The team is extremely transparent, and positions can be viewed in real-time as the protocol scales in size and influencer.

This is a very young concept that I think has a lot of potential to gain traction in the coming years, despite regulatory hurdles. Decentralized hedge funds, decentralized income products, and DAOs as a service will become commonplace in the new digital economy as more people live and work on-chain. I want to make it explicitly clear that REFI/NEWO are fairly low cap coins and I do not want to influence price, so this is not a call to buy them or similar projects—merely presentation of the idea of liquid DAOs and how capital allocation is shifting with the introduction of pooled funds and voting wars. Ape accordingly, and at your own discretion.

Last but not least, boomer coins:

Bitcoin

After a lackluster Q4 2021, Bitcoin is in a period of consolidation. Based off past trends, we typically consolidate for 60-90 days before moving higher after experiencing major sell-offs like we did over the past few weeks. I expect for us to range sideways throughout January, and start to pick up meaningful momentum February and beyond. Unless you are lower risk or managing a sizeable portfolio, owning BTC is suboptimal purely when it comes to maximizing portfolio growth.

Macro conditions permitting, I anticipate a move to $180,000 BTC in 2022 and for us to reach a secular top before entering a bear market. Compared to previous cycles, I expect this bear market to contain isolated categories of outperformance, where many coins are large unaffected or continuing to have their bull cycles despite the general market being down overall. The meta at this moment in time is finding sectors that are strong with upcoming catalysts (Curve Wars, Layer 2, gaming) and focus on the projects that are holding the strongest during the recent sell-off. These will be listed lower on this essay—for now the focus will shift to Ethereum.

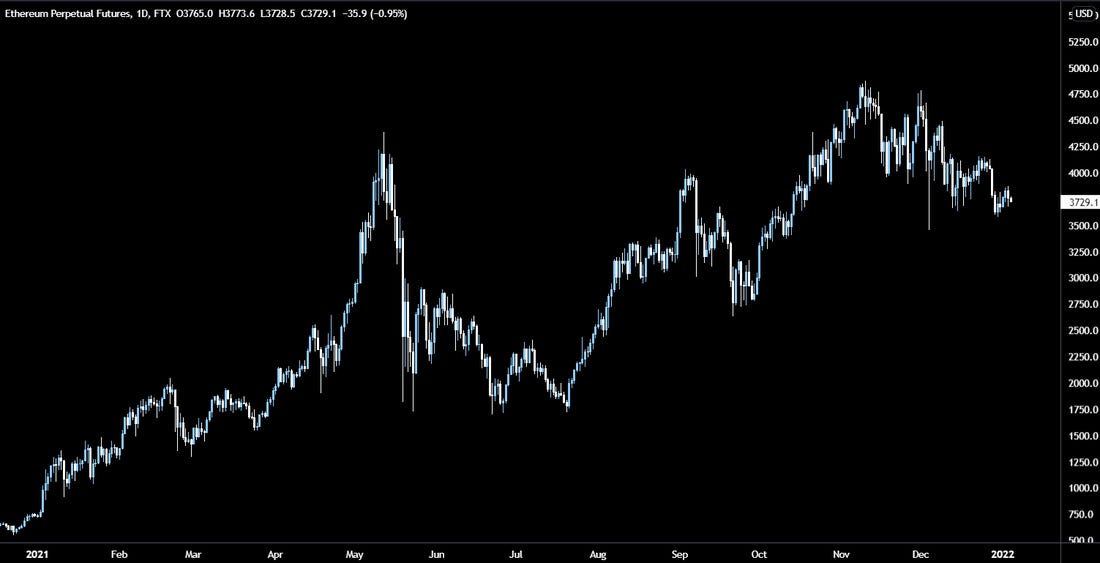

Ethereum

Ethereum has multiple macro catalysts in 2022 that will reshape the future of the protocol, lay the foundation for higher TPS scaling, and native privacy for all users. Around Q2 of this year, the transition from Proof-of-Work to Proof-of-Stake should be complete, making Ethereum substantially more energy efficient than Bitcoin and leading to a dramatic reduction in circulating supply due to staking. As ZK rollups gain traction and more protocols adopt the technology, a wide array of projects from gaming, DeFi, options, and structured products will be able to scale and onboard new users faster and with lower cost. Fee sensitivity has been a major theme plaguing Ethereum’s growth over the past 12 months. With rollups, these growing pains are alleviated as enable users to transact as frequently as they wish while paying considerably less in fees and exchanging value at a more rapid pace.

From a price perspective, providing macro conditions remain in tact, I expect ETH to continue its ascent to towards $10,000 towards middle/late 2022 heading into The Merge. It is possible that Ethereum will lag in price versus BTC or other top performing categories in the two months leading up to the merge, before dramatically outperforming afterwards. A similar phenomenon happened in 2020 when ETH had a major upgrade. For a while, price stalled, ETH lagged, the upgrade was passed, then there was a small dump. However, after the flywheel effect of the burn started to take place after people realized the network was running smoothly, and ETH began a parabolic run over the next 6 months. Smart money studied the mechanics of EIP-1559 in advance because information asymmetry is a huge edge when you’re trading wildly unregulated markets like crypto.

Pro tips: If we’re hyper-bullish going into the merge, take profits. It’ll likely be a sell the news event. If we’re flat, add to longs and hold until after it passes successfully and the market can shift resources to update to the new infrastructure. You should probably max long during this period of quiet, if it comes. The move upwards tends to have a delay. I will be tracking developments around ETH upgrades over the next six months to have an edge on contract deployments and progress made towards the End Game of Ethereum to position accordingly. In the mean time, my focus is on other narrative plays like FLAMingo, Curve Wars, and gaming as the market accelerates.

A Quick Note On Gaming

In the gaming space, two projects I am most bullish on are Defi Kingdoms $JEWEL and UFO Gaming $UFO. Both projects were bootstrapped, took zero VC funding, and have been able to bootstrap powerful communities while shipping code. With an excess of games built around hype and ponzinomics, JEWEL and UFO have put considerable time and though into their tokenomics, and are prioritizing playability and enjoyment of users over focusing purely on making the token price increase. Due to character restraints I am unable to cover both in detail here, but I would put these near the top of your list when it comes to projects that could settle in the top 5 by marketcap in the gaming sector of the industry. There is already a wealth of information out there about both, so I will leave it up to your curiosity to research more on both. In my view, both will be top 5 gaming protocols in 2022.

Disclaimer: I am an advisor to UFO, though I have been holding UFO and optimistic on the future of the protocol since before I ever spoke with the team.

Interesting areas people aren’t paying enough attention to:

Tokenized Leverage

Everlasting Options

Perpetual Pools (no margin/no liquidation)

Structured Products

Options Vaults

DAO to DAO management software

A DAO to lobby for DAO legislation

Getting a girlfriend

Upcoming releases to keep an eye on:

JPEG’d

Layer Zero

Celestia

Primitive

POKT Network

Overall, I am firmly in the bullish camp in Q1 2022 and expect for markets to finish higher across the board, continue to innovate rapidly with loose regulatory constraints, and enable breakthroughs in permissionless human and capital formation. If 2021 was the year of Bitcoin, then 2022 will be the year of Ethereum. With collective mindshare intently focused on scaling and multichain compatibility, any positive developments for Ethereum will trigger powerful second/third order effects that will resonate throughout the ecosystem and beyond.

Lastly, if you’re someone who still wants to “make it” and are a growth stage of your life, remember that crypto is the freest and most level playing field in the world. It is likely that more wealth will be created from crypto than any new industry of the past 100 years. You can do it, but don’t feel pressured to take on more risk than necessary because you feel like the bull market is ending or you are running out of time. Move calm and calculated, hold assets you believe in that are showing strength, and continuously search for new information. Your curiosity is your edge.

Great article

$CTK in Comos’ ecosystem will change everything